IT use of cloud surges to record heights

The cloud has reached the point where businesses are no longer debating whether or not to use cloud, but how pervasively they will use it. A new North Bridge survey shows record levels of corporate adoption of cloud computing, both for business functions and in the more complicated IT areas, especially to run content management and application development in the cloud.

IT teams are finally jumping on board, seeing a surprising level of cloud adoption this year, seizing back the reins on the technology strategy of their companies. From the bottom to the top, digital technologies delivered from the cloud are becoming differentiating factors for more businesses.

Cloud adoption is now reflected throughout entire business operations:

- Significant processing, systems of engagement and systems of insight are moving to the cloud. 81.3 percent of sales and marketing, 79.9 percent of business analytics, 79.1 percent of customer service and 73.5 percent of HR & Payroll activities have transitioned to the cloud. The impact on HR is particularly noteworthy as in 2011, it was the third least likely sector to be disrupted by cloud computing.

- IT is moving significant processing to the cloud with 85.9 percent of web content management, 82.7 percent of communications, 80 percent of app development and 78.9 percent of disaster recovery now cloud-based.

- While business users have been a fan of cloud’s ease of use, accessibility and scalability since 2011, the importance of cloud agility has leapt from fourth to second in importance in the last five years.

- Among all survey respondents, the top inhibitors to cloud adoption are security (45.2%), regulatory/compliance (36%), privacy (28.7%), lock-in (25.8%) and complexity (23.1%). Concerns regarding interoperability and reliability have fallen off significantly since 2011 (15.7% and 9.9% respectively in 2015).

- Cost of cloud services is three times as likely to be a concern today versus five years ago.

Expectations are shifting towards a new approach to the cloud:

- Three quarters of company data in significant volumes is living in private or public clouds. However, company data in hybrid cloud systems is forecast to double over the next two years.

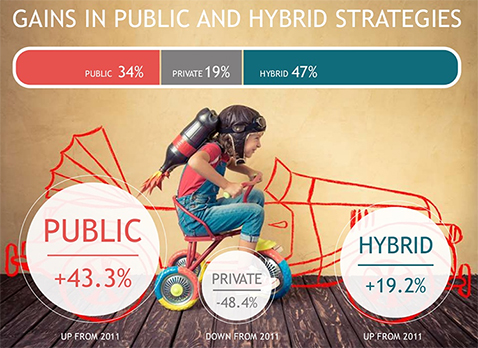

- Corporate cloud computing strategies are focusing on public (up 43.3%) and hybrid (up 19.2%) while private cloud has taken a significant back seat (down 48.4%).

- SaaS is the most pervasive cloud technology used today with a presence in 77.3 percent of all organizations, an increase of 9 percent since 2014. Accordingly, ROI expectations are high with 78 percent expecting to see results within three months. Fifty eight percent expect ROI in less than three months for PaaS services.

- Among users taking the survey, the biggest factors preventing use of public cloud offerings are security (38.6%), privacy (29.8%) and expertise (22.8%).

The vendor market is flexing to new expectations, customer structure, and business models:

- Vendor leadership/consolidation continues to take hold with 75 percent of companies using fewer than 10 vendors.

- While 61 percent of PaaS users only use one vendor, 71 percent of SaaS adopters use more than one vendor. 46 percent validate choosing multiple vendors due to the variation in capabilities.

- Seeking simple and clear relationships, over 50 percent opt for online purchasing or direct to provider purchasing of cloud services. Online buying is expected in increase in the next two years up to 56 percent.

- Seventy percent of customers interact directly with the cloud providers signaling huge changes to come for vendor business and go-to-market models.

Today, cloud use is less about adoption and more about the cloud at work. This was a theme witnessed throughout the 2015 results. Inhibitors have shifted from reliability and interoperability to pragmatic issues such as building the right network and tackling challenges such as security, regulation, privacy and lock-in. Even more telling, concern over cost has tripled in the last five years, a reflection of the competitive vendor landscape and the actualization of the cloud on budget reports at all levels.

Movement of data has fueled even more complexity and the limits of data transportability are being tested across Clouds. Thirty eight percent of respondents said that they have moved or considered moving from public cloud to private, with 40 percent of those respondents reporting technical difficulties moving the data.

The reemergence of IT’s use of cloud is one of the largest indicators of the normalization of cloud. Business uses often occur at a smaller scale, impacting specific teams within sales or customer service and growing slowly among similar teams. With IT’s full engagement, we expect to see the cloud blossom exponentially and a direct impact on the expansion of the hybrid cloud.