Top fraud and corruption trends

Highlighted by a dramatic rise in cyber security risk across all industries, EY Fraud Investigation & Dispute Services (FIDS) unveiled its top fraud and corruption trends for 2015.

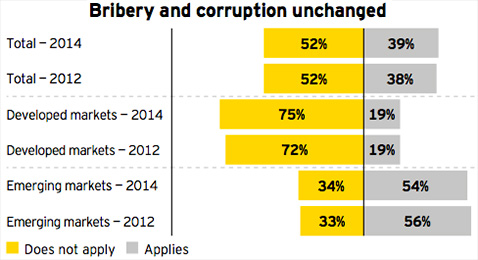

Bribery and corruption will challenge organizations and their Boards, especially in highly regulated industries such as financial services and life sciences, as they look to develop new approaches to mitigate these risks while balancing demands for global growth.

Key themes that companies should incorporate in their planning this year include:

1. Cyber readiness is challenging the C-Suite and Boards

The impact of cyber breaches continues to show that organizations and their Boards must become more aggressive in developing response plans to these persistent threats. A key component for strengthening an organization’s preparedness will be increased awareness of the variety of threat actors – including hacktivists and nation states.

Regulatory bodies expect companies to provide greater transparency through more robust disclosures and to undertake actions to buttress defenses and controls. For the majority of those surveyed in EY’s 13th Global Fraud Survey who did not view cybercrime as a significant risk, much work obviously remains to be done.

2. Increased focus on Foreign Corrupt Practices Act (FCPA) enforcement actions against individuals

Increased focus by the U.S. Securities and Exchange Commission (SEC) and Department of Justice on enforcement actions against individual executives is putting greater pressure on organizations to demand ethical corporate cultures and to develop a more detailed understanding of their anti-corruption compliance programs. A critical element of these programs is a robust, global third-party vetting process, continually evaluating the conduct and political exposure of joint venture partners, agents and distributors, among others.

3. Use of Forensic Data Analytics (FDA) in anti-bribery/anti-corruption monitoring and investigations

EY’s 2014 Global Forensic Data Analytics Survey found that 74% of respondents indicated that Forensic Data Analytics can play a critical role in mitigating corporate bribery, a top fraud risk, and 63% of respondents agree that they need to do more to improve their anti-fraud/anti-bribery procedures, including incorporating FDA. FDA will enable legal, compliance and internal audit professionals to be more effective by allowing them to analyze greater volumes of data from disparate sources in a much more timely fashion.

4. Regulated industries: Financial services

- Despite record settlements by top U.S. banks in 2014 related to mortgage-backed securities, financial institutions are expected to remain under intense regulatory scrutiny throughout 2015. The Consumer Financial Protection Bureau is expected to continue its focus on mortgage loans, student loans and credit cards, and will broaden to non-bank mortgage servicers and auto lenders whose compliance efforts may lag those of traditional banks.

- The scrutiny of potential manipulation of financial benchmarks and indices that began with London Interbank Offered Rate (LIBOR), and now includes foreign exchange trading, will continue in 2015.

- Regulatory pressure on private trading venues is likely to increase as dark pools and alternative trading systems have come under scrutiny by the U.S. SEC and other regulators.

- Global financial institutions will continue to face scrutiny on the issues of money laundering, terrorist financing, economic and trade sanctions, bribery and corruption, stressing the need for robust controls and monitoring systems. Regulatory scrutiny will continue to move beyond the traditional banking sector into non-banks, including insurance providers and gaming enterprises, increasing the need to review and enforce compliance programs and controls. This past year the industry has seen record fines and increased scrutiny on Office of Foreign Asset Control sanctions, quality of suspicious activity reporting, and due diligence around financial institutions’ customers. State regulators are now more frequently imposing independent monitors on financial institutions as part of the settlement process.

5. Regulated industries: Life sciences & healthcare

- Life Sciences: FCPA compliance will remain a top priority for companies operating in emerging and frontier markets.

- The past year’s enforcement actions continue to evidence the exposure that life sciences companies face when operating overseas. Life sciences companies must devote greater attention to compliance processes as well as overall internal control enhancements with a range of tools including Forensic Data Analytics. Varying levels of foreign enforcement and cooperation among governments will require life sciences companies to stay abreast of evolving global anti-corruption standards.

- Healthcare: Continued implementation of the Affordable Care Act will present new challenges and risks for providers and patients.

- As the implementation of the Affordable Care Act proceeds and new health information management efforts take hold, infrastructure in the healthcare industry will be tested. The nexus of government-sponsored health insurance programs and increased federal funding will present fraud risks because of the increased complexity between the systems and monitoring efforts.

Brian Loughman, EY Americas FIDS Leader, commented, “Our clients are continually challenged with bribery, corruption and cyber breaches while at the same time balancing the effectiveness of their compliance monitoring programs. Companies and their boards are seeking next generation technology applications to assist with these challenges. These solutions, though, must be tailored and scalable to address the sectors and geographies where they do business.”